Did you know that in the United States, insurance claims account for over $1.3 trillion in annual payouts? This huge figure shows how important it is to understand the insurance claim process. This article will help you navigate through insurance claim filings. It aims to empower you with the knowledge to manage your claims well and get the most from your insurance policies.

Key Takeaways

- Familiarize yourself with the different stages of the insurance claim process, from filing to settlement.

- Ensure you have the necessary documentation to support your claim and comply with your insurance provider’s requirements.

- Understand the roles and responsibilities of insurance claim adjusters and how they impact the claims process.

- Explore the benefits of digital claim submission methods and how they can streamline the overall process.

- Learn effective strategies for resolving disputes and navigating the claim appeals process.

Navigating the Complexities of Insurance Claim Filings

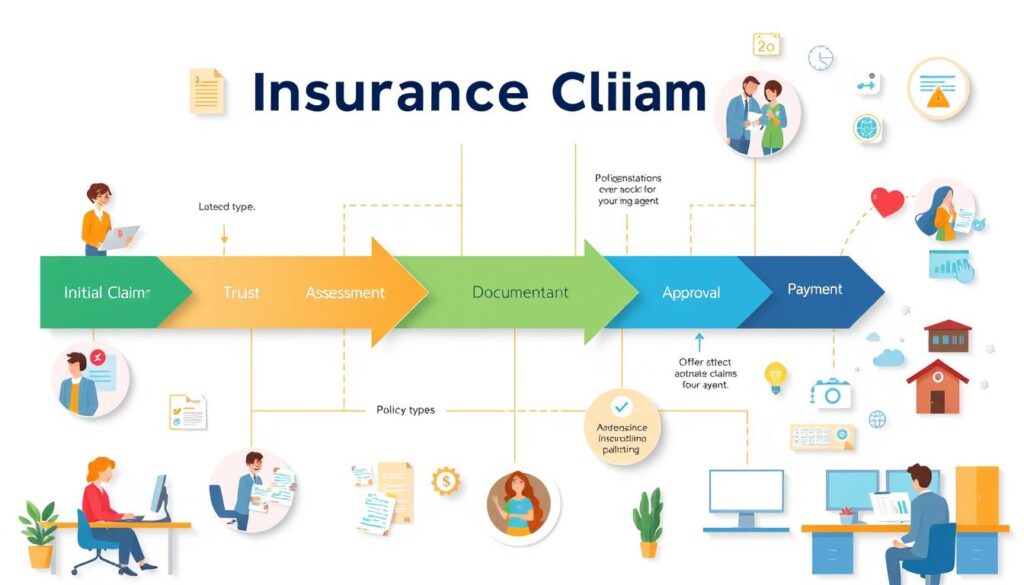

Understanding the insurance claim filing process is key. It involves gathering important documents and choosing how to submit them. Policyholders must carefully follow the steps for claim documentation requirements and claim submission methods.

Gathering Essential Documentation

The first step is to collect all needed documents. This includes proof of the incident, like police reports or repair estimates. It’s also important to review the insurance policy coverage thoroughly. Having all the right documents helps make the traditional claim filing process smoother and increases the chance of a successful claim.

Claim Submission Methods: Traditional vs. Digital

After gathering documents, policyholders must choose how to submit their claim. There are two main options: traditional claim filing with paper forms or digital claim submissions through online portals or mobile apps. Digital methods are often quicker and more convenient. Policyholders should consider the pros and cons of each to find the best one for them.

By knowing what documents are needed and the different claim submission methods, policyholders can confidently handle the insurance claim process. This ensures their claims are processed efficiently.

insurance claim process education: Empowering Policyholders

Dealing with insurance claims can be tough. But, with the right insurance claim process education, you can handle your claims well. This way, you can make sure your claim goes smoothly.

Knowing how to handle claim dispute resolution is key. You should know your rights and how to deal with insurance companies. This knowledge helps you stand up for yourself and get a fair deal.

Insurance fraud prevention is also important. You need to spot fake claims and protect yourself. By doing this, you help keep the insurance system honest.

Getting personalized claim assistance is very helpful too. Having someone to guide you makes the process easier. They make sure your specific needs are met, making things go more smoothly.

Investing in insurance claim process education makes your claims experience better. You’ll know how to deal with disputes, avoid fraud, and get the help you need. It’s all about being informed and confident.

Being well-informed makes you a stronger policyholder. Take the time to learn and make your claim experience better.

Conclusion

Navigating the insurance claim process can be complex. But, with the right insurance claim process education and a proactive approach, you can have a successful claim. This protects your financial well-being.

It’s important to understand the claim filing procedures and keep all necessary claim documentation requirements in order. Knowing about digital claim submissions is also key. Plus, knowing your insurance policy coverage and the role of claim adjusters helps a lot.

The insurance industry is always changing. Policyholders need to keep up with new things like claim processing timelines and claim dispute resolution. They also need to know about insurance fraud prevention. By using available resources and getting personalized claim assistance when needed, you can confidently go through the insurance claim process. This way, you make sure your rights are protected.

FAQ

What is the insurance claim process?

The insurance claim process is how you get help from your insurance after something bad happens. You need to collect your documents, file the claim, and work with the insurance company. This helps you get the payment or help you need.

What documentation do I need to file an insurance claim?

You’ll need a few things to file a claim. These include a detailed report of what happened, any receipts, photos of the damage, and your insurance policy. The exact things you need might change based on your claim and the insurance company.

Can I file an insurance claim online?

Yes, many insurance companies let you file claims online. This makes it quicker and easier. But, you can still file on paper if you prefer.

How long does the insurance claim process take?

How long it takes to process a claim varies. It depends on the claim’s complexity, the insurance company, and the coverage. Most aim to finish within 30 days. But, some might take longer. Always keep in touch with your insurance company.

What can I do if my insurance claim is denied?

If your claim is denied, you can appeal. You’ll need to provide more information or documents. Many insurers have special processes to help with disputes.

How can I prevent insurance fraud?

To avoid fraud, always tell the truth and provide accurate info. Keep good records and cooperate with investigations. Don’t make up or exaggerate claims to keep the system fair.

What kind of personalized assistance is available for insurance claims?

Many insurers offer personal help with claims. They have claim reps or case managers. They can guide you on what you need, explain your policy, and help talk to the insurance company.